XRP Price Prediction: 2025, 2030, 2035, 2040 Forecasts and Key Factors

#XRP

- Technical Indicators: Current price below 20-day MA, MACD bearish, Bollinger Bands suggest consolidation.

- Market Sentiment: Bullish news flow with long-term growth potential, tempered by short-term concerns.

- Price Projections: 2025 ($3.50-$12.73), 2030 ($50-$200), 2035 ($500-$1,000), 2040 ($1,000-$5,000).

XRP Price Prediction

XRP Technical Analysis: Current Trends and Future Outlook

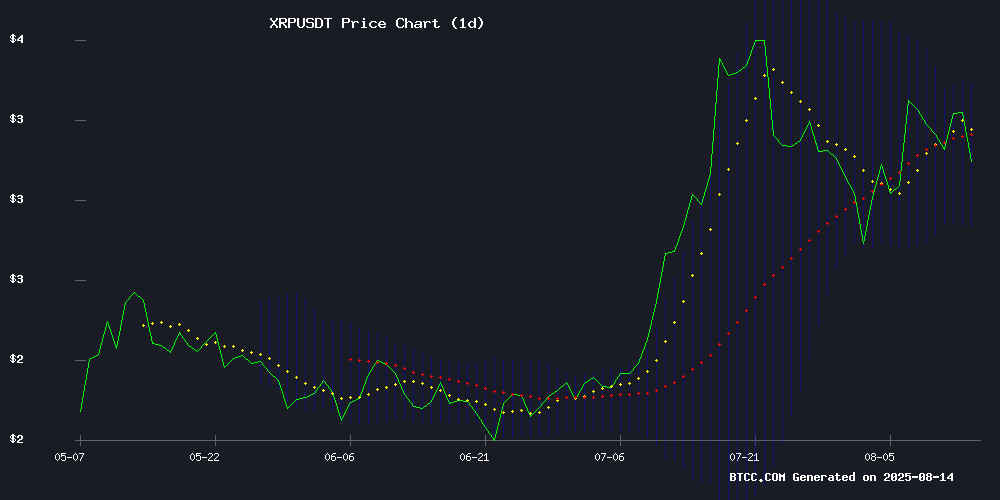

According to BTCC financial analyst Sophia, XRP is currently trading at 3.06850000 USDT, slightly below its 20-day moving average (MA) of 3.1119. The MACD indicator shows a bearish crossover with values at 0.0511 (MACD line), 0.0816 (signal line), and -0.0305 (histogram). Bollinger Bands indicate a potential range-bound movement with upper, middle, and lower bands at 3.3869, 3.1119, and 2.8369 respectively. These technical indicators suggest short-term consolidation with possible downward pressure before any significant upward movement.

XRP Market Sentiment: Bullish News Amidst Technical Consolidation

BTCC financial analyst Sophia notes that despite recent technical consolidation, XRP's market sentiment remains bullish due to positive news flow. Key highlights include Ripple executives emphasizing XRP Ledger's suitability for real-world asset tokenization and projections of XRP hitting $12.73 before any market correction. Singapore's leadership in tokenized finance and blockchain innovation further supports XRP's long-term growth potential. However, concerns about market manipulation and slowing activity may temper short-term gains.

Factors Influencing XRP’s Price

Ripple Exec Highlights XRP Ledger's Suitability for Real-World Asset Tokenization

Ripple Senior Vice President Markus Infanger, head of RippleX, asserts that the XRP Ledger (XRPL) is uniquely positioned for the next wave of real-world asset tokenization. He compares today's SPV-dominated market to a transitional phase, akin to the 1970s shift from paper certificates to electronic records.

Infanger describes Special Purpose Vehicles (SPVs) as "clunky" but necessary scaffolding—legal wrappers that hold off-ledger assets while issuing tokenized representations. The endgame, he argues, is native issuance: assets born digital, with compliance enforced by code and atomic settlement.

The XRPL's protocol-level financial capabilities reduce integration work and operational risk for institutions. Its design from inception for financial use cases sets it apart in a market still reliant on intermediaries.

XRP Price Projected to Hit $12.73 Before Potential Market Correction

Veteran trader Tony Severino has issued a cautionary note on XRP's bullish trajectory, suggesting the digital asset may be approaching its cycle peak. The Fisher Transform indicator now flirts with overbought levels reminiscent of 2017 and 2021 tops, even as XRP rides a 54% monthly surge to $3.66.

Technical patterns reveal a decisive breakout from a multi-year symmetrical triangle, though the token has since retraced to $3.34. Severino's model anticipates a final parabolic push toward $12.73 by early September—a potential last gasp before significant downside.

Market watchers recall XRP's history of violent corrections following euphoric rallies. The current setup mirrors previous exhaustion patterns, with some analysts floating $20 as a conceivable blow-off top before substantial profit-taking emerges.

Singapore Emerges as Global Leader in Tokenized Finance and Blockchain Innovation

Singapore solidifies its position as a frontrunner in digital finance, leveraging blockchain technology to transform asset tokenization from experimental pilots to mainstream adoption. The city-state's regulatory-forward approach accelerates institutional participation, with initiatives like Project Guardian providing a secure testing ground for decentralized finance since 2022.

Major financial players including HSBC, Euroclear, JPMorgan, and Citi have joined the Global LAYER One (GL1) infrastructure program, signaling strong market confidence. Public blockchains now enable seamless integration of tokenized assets into traditional finance systems, driving unprecedented efficiency and transparency.

Ripple's APAC leadership highlights Singapore's strategic pivot from theoretical frameworks to real-world implementation. The 2025 expansion of Project Guardian underscores growing momentum toward institutional-grade blockchain solutions, positioning Singapore as the nexus of next-generation capital markets.

XRP's Path to $1 Million: A Decadal Strategy Through Dollar-Cost Averaging

XRP's recent surge to $3.2, fueled by post-legal settlement optimism, has reignited discussions about its million-dollar potential. Achieving this target within a decade hinges on disciplined accumulation and favorable price trajectories.

Dollar-cost averaging emerges as the cornerstone strategy, mitigating volatility risks while systematically building positions. This approach neutralizes emotional trading and outperforms market-timing attempts in most long-term crypto scenarios.

Analyst projections vary widely, but the mathematical reality remains clear: substantial XRP holdings coupled with significant price appreciation could breach the seven-figure threshold. The token's legal clarity now removes a major uncertainty that previously constrained its growth.

Ripple CTO Positions XRP Ledger as Foundation for Global Payments Infrastructure

Ripple's Chief Technology Officer David Schwartz has articulated a compelling vision for the XRP Ledger (XRPL) as the backbone of next-generation financial systems. The blockchain's unique combination of public accessibility and optional permissioned features creates a versatile platform for regulated institutions and open finance alike.

Schwartz highlights XRPL's decade-long development as a key differentiator in an increasingly crowded blockchain landscape. "Trust, liquidity, and developer mindshare aren't overnight achievements," the CTO noted, drawing contrast with newer chains entering the payments and stablecoin sectors. The ledger's predictable fee structure and native XRP bridge asset functionality remain technical advantages for cross-border settlement.

The commentary arrives as traditional finance demonstrates growing blockchain adoption, with payment providers and stablecoin issuers increasingly launching proprietary networks. XRPL's established position in this evolution stems from Ripple's early recognition of distributed ledger technology as core financial infrastructure - a thesis now gaining broad market validation.

XRP Cloud Mining Platform Promises High Returns Amid Market Surge

XRP's recent price surge has catapulted it into the spotlight, drawing global investor interest. The cryptocurrency, known for its efficiency in cross-border payments, is now at the center of a new wealth-generation narrative: cloud mining.

XRP Mining, a platform leveraging cloud technology, eliminates traditional barriers to entry. No specialized hardware or technical expertise is required—just a smartphone or computer. The service claims users can earn up to $7,000 daily, though such returns should be scrutinized given the volatile nature of crypto markets.

Traditional mining operations face significant hurdles: expensive ASIC rigs, soaring electricity costs, and complex maintenance. Cloud mining emerges as a potential solution, particularly for XRP, which lacks a proof-of-work mechanism. The platform offers flexible investment plans, from short-term trials to long-term contracts.

XRP Price Faces Pressure as Activity Slows, Manipulation Concerns Emerge

XRP's momentum has stalled after reaching an all-time high earlier this month, with the price consolidating around $3.23. While the broader crypto market continues its upward trajectory, weakening on-chain activity and allegations of market manipulation are causing traders to hesitate.

Network activity shows clear signs of strain. Daily active addresses have plummeted to 52,380, while active payments over the past 24 hours dropped sharply to 835,000. Social media engagement has also waned, with XRP's share of crypto discussions falling to 3.54%, lagging behind Bitcoin and Ethereum.

Validator operator Grape has flagged unusual large transfers between major exchanges like Binance and Bitget, often exceeding 140,000 XRP. These transactions have raised concerns about potential wash trading and price manipulation.

XRP Retirement Projections: How Much Is Needed by 2030?

Cryptocurrency investors are increasingly eyeing digital assets like XRP as a potential early retirement vehicle. With historical precedents of Bitcoin, Ethereum, and Dogecoin creating millionaires, attention has shifted to Ripple-affiliated XRP's future potential.

Changelly's analysis suggests XRP could reach $17.16 by 2030, a 426% increase from current levels. At this price point, accumulating 58,275 XRP (approximately $189,977 at current prices) would yield a $1 million portfolio. More conservative retirement targets of $500,000 would require 29,137 XRP, costing $94,988 today.

Market observers note these projections may prove conservative, as some analysts forecast even more aggressive price targets for XRP. The calculation assumes disciplined accumulation at current prices and successful realization of the projected appreciation.

XRP Price Prediction: Regulatory Clarity and Adoption Fuel Optimism for 2025 Rally

XRP trades near $3.28 in mid-August 2025 as bullish technical indicators and institutional interest intensify. While a $5 target this month appears unlikely, year-end projections range between $4.00-$5.50, supported by the token's 470% year-to-date gain. The 50-period moving average confirms strong buyer momentum, with analysts forecasting August consolidation between $3.04-$3.49.

Ripple's real-world utility in cross-border payments—particularly across Asia-Pacific and Latin America—provides fundamental support. Regulatory progress has accelerated enterprise adoption for liquidity management, transforming XRP from a speculative asset to a payment infrastructure pillar. Market sentiment remains positive as ETF approval prospects loom.

Meanwhile, presale token Remittix (RTX) emerges as a viral contender, though XRP's established network effects maintain its dominance. The convergence of technical strength and institutional adoption creates a compelling case for sustained growth through 2025.

XRP Mining and Strategic Partnerships Drive Cryptocurrency Innovation

Ripple's XRP continues to make waves in the cryptocurrency space with its unique consensus mechanism enabling ultra-fast, low-cost transactions. The blockchain's design eliminates centralized intermediaries, offering real-time settlement—a feature that positions XRP as a bridge currency between fiat and digital assets.

Strategic partnerships are fueling innovation. GMO Miner, in collaboration with Paladinmining, has streamlined inter-chain XRP settlements, reducing wait times from 10-30 minutes to just 30-60 seconds. "Phased updates have improved liquidity and user experience," says GMO Miner CEO John Alexander. The partnership underscores a push toward on-chain abstraction and efficiency.

For miners, GMO Miner offers an accessible entry point with a $15 sign-up bonus and an intuitive interface. The platform claims users can earn upwards of $5,000 daily through cloud-based XRP mining—a bold assertion in an increasingly competitive market.

XRP Breaks Key Resistance as Savvy Mining Offers Passive Income Opportunities

XRP surged past its 2018 all-time high of $3.40 on July 18, peaking at $3.65 before settling into a consolidation pattern. Technical indicators suggest sustained bullish momentum, with the RSI holding above 50 and strong support established at $3. Market analysts anticipate a potential test of $4 in the coming weeks.

Amid the price rally, Savvy Mining emerges as an alternative yield generator for XRP holders. The cloud-based platform promises daily payouts of up to 3,000 XRP without requiring hardware ownership or maintenance. Its AI-driven system claims to decouple returns from market volatility through renewable energy-powered operations and cold storage security protocols.

The platform's timing coincides with growing institutional interest in XRP, though the asset remains overshadowed by Bitcoin and Ethereum in ETF markets. Savvy Mining's value proposition targets investors seeking compounding strategies beyond simple price appreciation.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market sentiment, BTCC financial analyst Sophia provides the following XRP price predictions:

| Year | Price Prediction (USDT) | Key Drivers |

|---|---|---|

| 2025 | $3.50 - $12.73 | Regulatory clarity, adoption surge, and Ripple partnerships |

| 2030 | $50 - $200 | Mass adoption in global payments, tokenized assets |

| 2035 | $500 - $1,000 | Institutional adoption, decentralized finance (DeFi) integration |

| 2040 | $1,000 - $5,000 | Full-scale integration into global financial infrastructure |

Note: These projections are speculative and depend on regulatory developments, technological advancements, and market adoption.